Consider the nature of your business, the types of transactions you make, and the financial reports you need to generate. A chart of accounts template can be easily customized to fit the needs of your business. While you should still maintain consistency with standard accounting principles, accounts can be tailored to track the activity that’s most essential to your understanding of the business’s finances. Within each of these account types are a wide variety of specific accounts that reflect standardized categories or the unique operations of your business. As your business grows, so will your need for accurate, fast, and legible reporting. Your chart of accounts helps you understand the past and look toward the future.

How to Create a Chart of Accounts

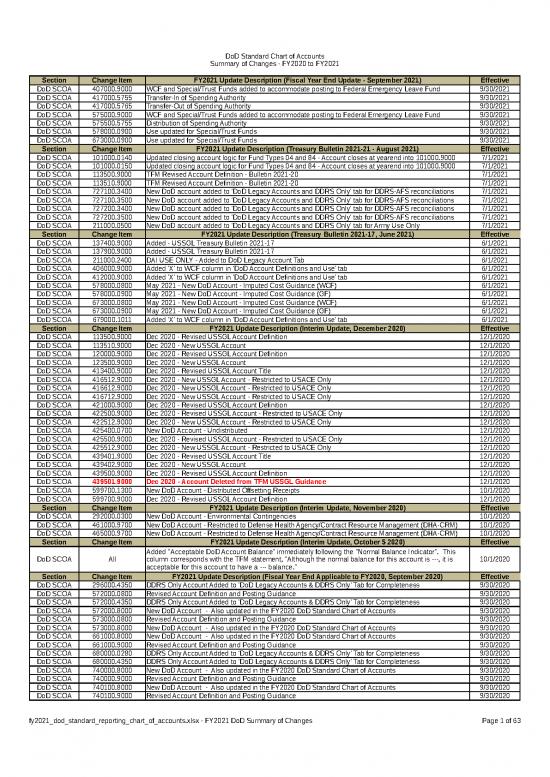

The most important component when working with a chart of accounts is consistency, which enables the comparison of financials across multiple accounting periods and business units. For example, companies in the United States must have certain accounts in place to comply with the tax reporting requirements of the IRS (Internal Revenue Service). One of the IRS stipulations is that expenses like travel and entertainment should be tracked in individual accounts.

How to Create a Better Chart of Accounts (Free Excel Template)

Selling furniture for more than you bought it when you aren’t a furniture company is a common example of a gain. Another example would be winning a lawsuit for copyright infringement if you aren’t a law firm. For example, if you have a consulting firm, consulting fees are your revenue.

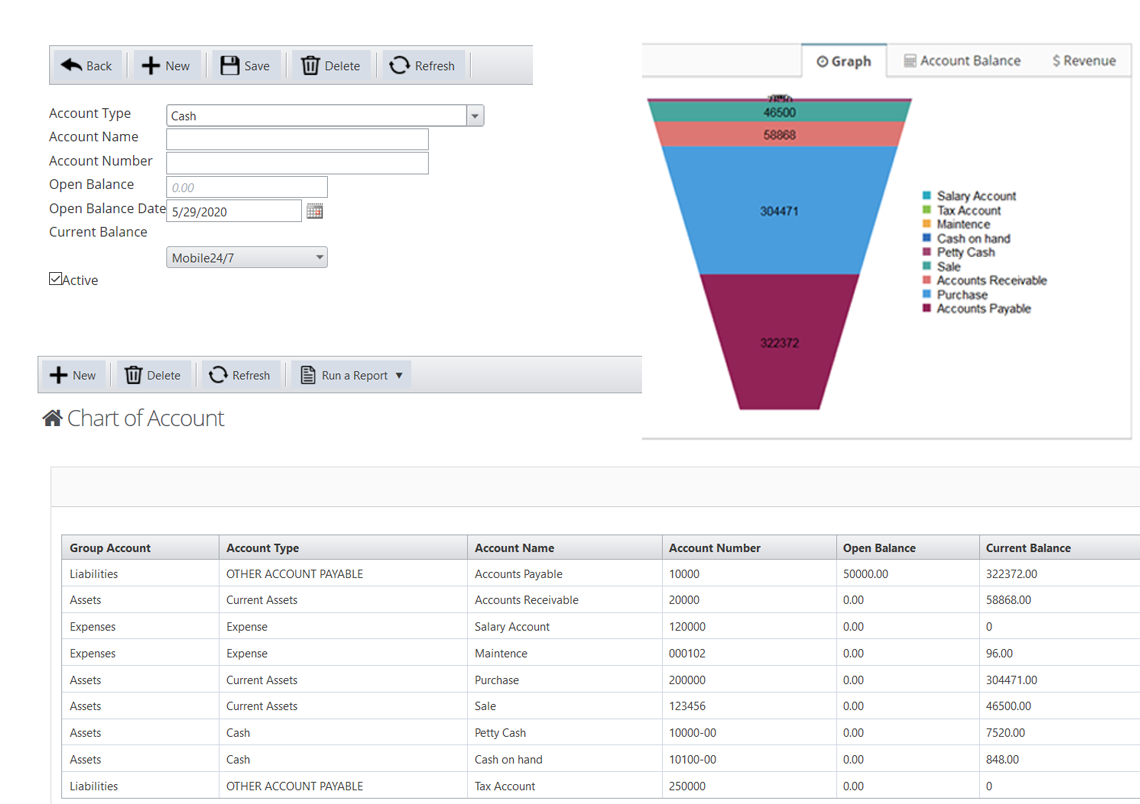

Create a sample Chart of Accounts for for small business

The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. Looking at the COA will help you determine whether all aspects of your business are as effective as they could be. If you keep your COA format the same over time, it will be easier to compare results through several years’ worth of information. This acts as a company financial health report that is useful not only to business owner, but also investors and shareholders. See a free Excel template with a standard chart of accounts with payroll expenses, etc.

Chart of accounts: Definition, how to set up, and examples

Many small businesses opt to utilize online bookkeeping services, not only for invoicing and expense tracking but also for organizing accounts and ensuring tax season goes smoothly. FreshBooks accounting software is an affordable and reliable option for online bookkeeping services that will help you stay on track and grow your business. This organization will help you manage your financial transactions efficiently and generate accurate financial reports. For instance, within the asset category, you might have subcategories like cash, accounts receivable, and inventory. Common categories include assets, liabilities, equity, income, and expenses.

Create business account names

- For example, if you have unneeded categories in your COA, it’s usually not a good idea to eliminate them mid-period due to possible orphaned data in your financial statements.

- Also, accounting software packages tend to come with a set of predefined charts of accounts for different types of businesses in variety of industry sectors.

- The account name is the given title of the business account you’re reporting on, such as bank fees, cash, taxes, etc.

- Firstly, it helps businesses organize their financial transactions and track their financial performance.

- The purpose of the sub-group is to classify each account into categories that the business need to produce the balance sheet and income statement for accounting reports.

This sample chart of accounts provides an example using some of the most commonly found account names. Yes, it is a good idea to customize your chart of accounts to suit your unique business. The chart of accounts allows you to organize your business’s complex financial data and distill it into clear, logical account types. It also lays the foundation for all your business’s important financial reports. Charts of accounts are an index, or list, of the various financial accounts that can be found in your company’s general ledger.

The Chart of Accounts is an indispensable tool in the realm of accounting, vital for accurate and efficient financial management. Understanding its structure, types, and best practices is key to maintaining an organized financial record-keeping system. Clear and descriptive account names help users understand the purpose of each account and reduce confusion when reviewing financial statements.

Now, that said, we’d be remiss if we didn’t boast a bit and say that Embark’s COA template is a heckuva starting point. Specifically, you want to use an identifier numbering system that provides plenty of real estate for you to add account categories down the road without having to reinvent the COA wheel. There’s nothing special about the balance sheet accounts you use within your COA since they flow into the balance sheet you already know and love. Even worse, if your competition has a highly efficient and streamlined COA, they will always have a competitive advantage over you.

The bookkeeper would be able to tell the difference by the account number. An asset would have the prefix of 1 and an expense would have a prefix of 5. This structure can avoid confusion in the bookkeeper process and ensure the proper account is selected when recording transactions. You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can what is a leasehold use to record transactions, make reports, and prepare financial statements throughout the year. A standard COA will be a numbered list of the accounts that fill out a company’s general ledger, acting as a filing system that categorizes a company’s accounts. It also helps with recording transactions and organizing them by the accounts they affect to help keep the finances organized.