If the D/E ratio of a company is negative, it means the liabilities are greater than the assets. As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade. Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2).

Limitations Of The Debt To Equity Ratio

The ratio looks at debt in relation to equity, providing insights into how much debt a company is using to finance its operations. In our debt-to-equity ratio (D/E) modeling exercise, we’ll forecast a hypothetical company’s balance sheet for five years. In the majority of cases, a negative D/E ratio is considered a risky sign, and the company might be at risk of bankruptcy. However, it could also mean the company issued shareholders significant dividends.

Is an increase in the debt-to-equity ratio bad?

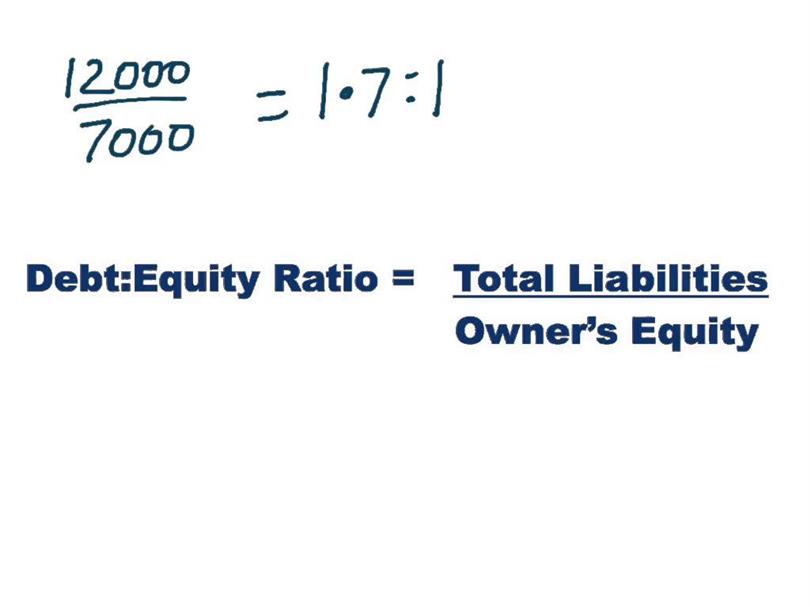

Suppose a company carries $200 million in total debt and $100 million in shareholders’ equity per its balance sheet. The formula for calculating the debt-to-equity ratio (D/E) is equal to the total debt divided by total shareholders equity. Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash. They can also issue equity to raise capital and reduce their debt obligations. This tells us that Company A appears to be in better short-term financial health than Company B since its quick assets can meet its current debt obligations.

Debt to Equity Ratio Explained

This is because long-term liabilities are more expensive and risky than short term debts. The debt-to-equity ratio or D/E ratio is an important metric in finance that measures the financial leverage of a company and evaluates the extent to which it can cover its debt. It is calculated by dividing the total liabilities by the shareholder equity of the company. If, as per the balance sheet, the total debt of a business is worth $50 million and the total equity is worth $120 million, then debt-to-equity is 0.42.

Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle. It suggests that a company relies heavily on borrowing can you cancel a po sent to a supplier to fund its operations, often due to insufficient internal finances. Essentially, the company is leveraging debt financing because its available capital is inadequate.

What Is a Good Debt-to-Equity Ratio and Why It Matters

- Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt.

- However, the treatment of retained earnings in the calculation of the debt-to-equity ratio is consistent under both IFRS and US GAAP.

- The debt-to-equity ratio is one of several metrics that investors can use to evaluate individual stocks.

- As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context.

- The debt-to-equity ratio is a way to assess risk when evaluating a company.

- A high D/E ratio indicates that a company has been aggressive in financing its growth with debt.

Very high D/E ratios may eventually result in a loan default or bankruptcy. In the banking and financial services sector, a relatively high D/E ratio is commonplace. Banks carry higher amounts of debt because they own substantial fixed assets in the form of branch networks. Higher D/E ratios can also tend to predominate in other capital-intensive sectors heavily reliant on debt financing, such as airlines and industrials. What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky.

To determine the debt to equity ratio for Company C, we have to calculate the total liabilities and total equity, and then divide the two. Debt to equity ratio is the most commonly used ratio for measuring financial leverage. Other ratios used for measuring financial leverage include interest coverage ratio, debt to assets ratio, debt to EBITDA ratio, and debt to capital ratio.

In other industries, such as IT, which don’t require much capital, a high debt to equity ratio is a sign of great risk, and therefore, a much lower debt to equity ratio is more preferable. With high borrowing costs, however, a high debt to equity ratio will lead to decreased dividends, since a large portion of profits will go towards servicing the debt. Another benefit is that typically the cost of debt is lower than the cost of equity, and therefore increasing the D/E ratio (up to a certain point) can lower a firm’s weighted average cost of capital (WACC). Gearing ratios constitute a broad category of financial ratios, of which the D/E ratio is the best known. The personal D/E ratio is often used when an individual or a small business is applying for a loan. Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income.